Dakuku

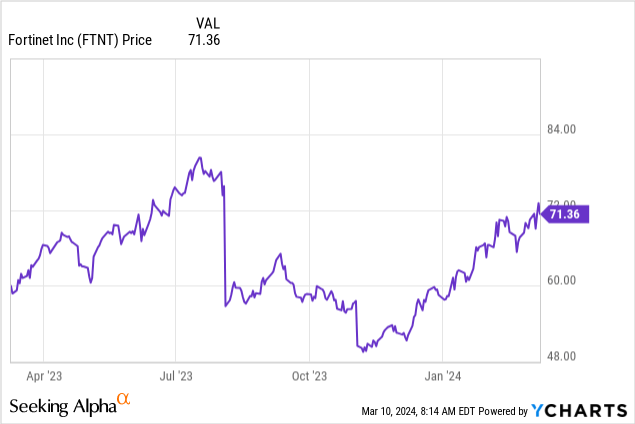

Fortinet, Inc. (NASDAQ:FTNT) seems to be at a crossroads after recouping most of its losses since an almost 20% decline in August 2023. The firm’s inventory has been within the $71 to $73 vary for a while, and each Wall Street and Quant have given it a maintain ranking, because the inventory trades at a excessive ahead promote a number of of 220 instances.

Data by YCharts

Data by YCharts

At the identical time, developments within the cybersecurity {industry} are additionally altering and influenced by new financial realities. In this context, this paper goals to point out that an organization is extra of a maintain by evaluating its means to realize market share towards opponents.

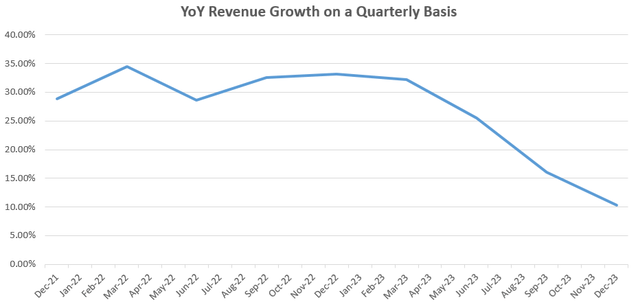

First, let’s take a look at income progress.

Declining income progress charge

As proven within the chart under, year-over-year income progress on a quarterly foundation has declined from greater than 30% in 2021 and 2022 to round 10%.

Graph created utilizing information from (seekingalpha.com)

There are two causes for this decline.

First, the digital transformation led to by the COVID-19 pandemic has quickly elevated the quantity of IT information residing each within the cloud and on-premises (or in company server rooms). With extra workers working from dwelling and distant workplaces and needing entry to company information, additionally they wanted safety from malicious actors, so new IT community routes wanted to be created. As a outcome, the corporate was in a position to promote extra routers, firewalls, and different safety merchandise, explaining the excessive income progress seen within the 2020-2021 interval.

Against this backdrop, the expansion Fortinet continues to get pleasure from in 2022 appears considerably uncommon on condition that tools substitute cycles are sometimes round 4 years. This is as soon as once more defined by the affect of the coronavirus on provide chains, with factories in East Asia, particularly China, being closed for lengthy intervals because the pandemic drags on. As a instinctive response, each the service and his CSP constructed up stock by putting extra orders with Fortinet, leading to elevated gross sales.

This means the corporate’s gross sales are benefiting from extra distorted market circumstances than regular demand in 2022, with gross sales declining at a time when prospects have a number of stock to burn. It appears pure to take action.

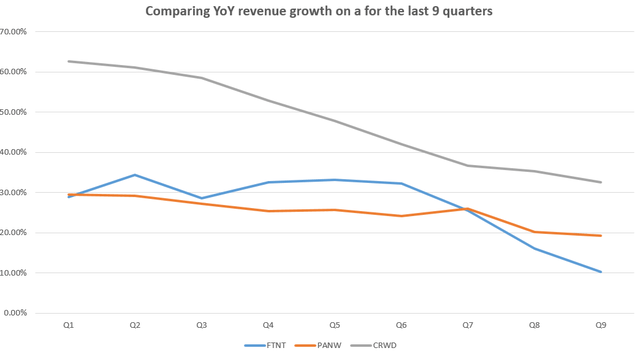

Second, Fortinet is shedding market share attributable to competitors within the cybersecurity {industry} towards corporations whose authentic background was networking to internally phase customers inside an enterprise. Routers have since developed by including firewall capabilities, however initially they have been all appliance-based. These later developed to be software-defined because the networking and cybersecurity markets quickly modified, permitting them to fight each rising threats and more and more subtle hackers.

In this regard, competitor Palo Alto (PANW) additionally developed from a networking background, later catering to enterprise safety wants, and quickly reworked its merchandise to turn out to be extra platform-oriented. At the identical time, the market has additionally seen the emergence of cloud-based suppliers like CrowdStrike (CRWD), whose merchandise have already been distributed from the cloud since its inception.

Comparing in accordance with the chart under, each Palo Alto and CrowdStrike are affected by income decline, however not as a lot as Fortinet. This, in a means, confirms that aggressive elements, along with the normalization of provide chain circumstances, are liable for the lack of market share.

Table created utilizing information from (www.seekingalpha.com)

Changing product course within the face of adjusting cybersecurity {industry} dynamics

Looking additional, market dynamics are additionally altering as prospects face increased prices of capital and not have the liberty to decide on particular person suppliers for every operate they want, reminiscent of endpoint safety, community firewalls, and safety operations required by the enterprise. It’s altering. IT infrastructure is monitored 24/7. This implies that persons are extra doubtless to decide on to purchase in bulk if there is a chance for a reduction. Similarly, he prefers to decide on one provider whose techniques are already built-in to leverage information obtained from endpoint or firewall logs to realize well timed insights and keep away from service interruptions. It’s cheap.

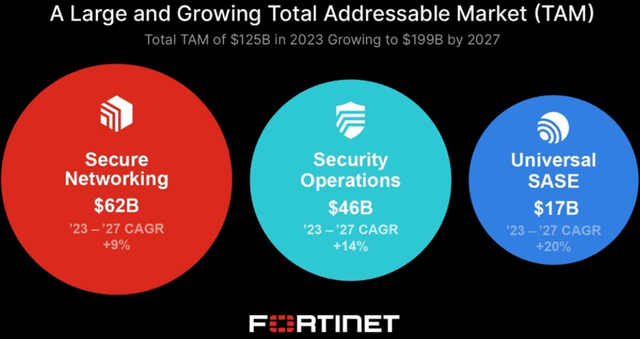

The above two arguments led to Fortinet’s largest transaction within the fourth quarter of 2023 (This autumn) involving three of the corporate’s merchandise, particularly Secure Networking, Security Operations, and Universal SASE, as proven within the diagram under. This could also be why the entire above have been included. So as an alternative of selecting one product from three completely different suppliers, he selected all three from Fortinet.

To this finish, since November final yr, the corporate has been refocusing on the three areas talked about above and adapting its merchandise to the fast-growing cybersecurity market. The purpose was not solely to deal with the rising variety of threats rising as a result of proliferation of AI-based assaults, but in addition to answer adjustments in buyer consumption patterns, as mentioned earlier.

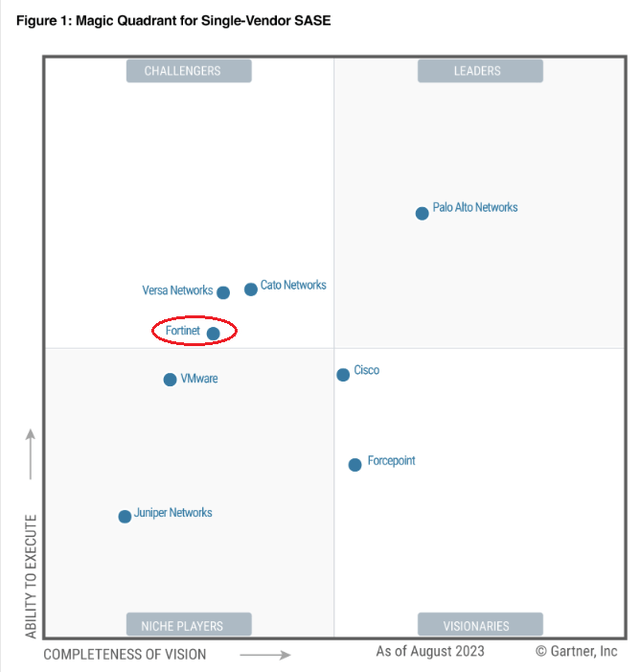

The readjustment additionally included aligning R&D investments to probably the most in-demand merchandise, and Fortinet streamlined its analysis and growth (R&D) efforts by specializing in a number of key areas. This paid off, and the corporate was named as a Single Vendor SASE Challenger in his August 2023 Gartner Magic Quadrant, as proven under.

www.fortinet.com

For buyers, SASE goals to enhance the efficiency of functions on the community edge or within the suburbs (distant workplaces) whereas offering the safety controls that customers sometimes get pleasure from in metro information facilities.

Emerging as a challenger now may enhance its competitiveness and assist it acquire market share, however for the inventory to be rated a purchase, we have to look deeper and see how a lot gross sales it has available in the market. It can also be essential to test how a lot is anticipated. subsequent quarter.

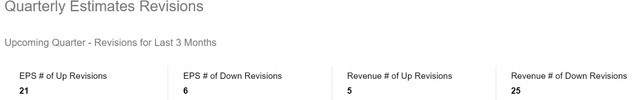

Freemium lowers income expectations and reduces aggressive dangers

To this finish, analysts have revised earnings estimates downward 25 out of 30 instances within the final three months, as proven under. Therefore, the income forecast for Q1 2024 has been lowered from $1.47 billion to $1.34 billion. This represents solely 8.8% year-on-year progress in comparison with the $1.26 billion achieved in Q1 2023. This represents single-digit progress, and means that the blue earnings chart above may fall additional.

seekalpha.com

This potential for single-digit progress is supported to some extent by fourth-quarter billings, which elevated solely 8.5% year-over-year. While that is actually higher than the 5.7% YoY enhance within the earlier quarter (Q3), the forecast for Q1 2024 reveals a 5.5% YoY decline. For buyers, an bill is an bill despatched to a buyer for cost, which is translated into revenue on the revenue assertion. In this regard, all of the numbers above are considerably decrease from his 2021 to his 2023, indicating that income progress is slowing down.

Additionally, Canalys analysis reveals that IT spending is anticipated to extend by 6% in 2024, with one of many precedence areas being cybersecurity, or SASE. This is as a result of want for simplicity in an more and more complicated community safety atmosphere as the character of cyber-attacks evolves.

If you concentrate on it, Palo Alto’s new progress technique may have industry-wide implications, given its final objective of distancing itself from opponents, and given its $90 billion market worth. The firm competes immediately with Fortinet for his SASE and is a frontrunner in accordance with his Gartner Magic Quadrant above.

Fortinet is in a greater place on the subject of ASICs

Therefore, if claims decline additional on account of some prospects switching to opponents, Fortinet’s inventory value may decline. On the opposite hand, it may additionally struggle again and supply free trials to counter the affect of Palo Alto’s freemium technique. You may supply reductions to draw potential prospects.

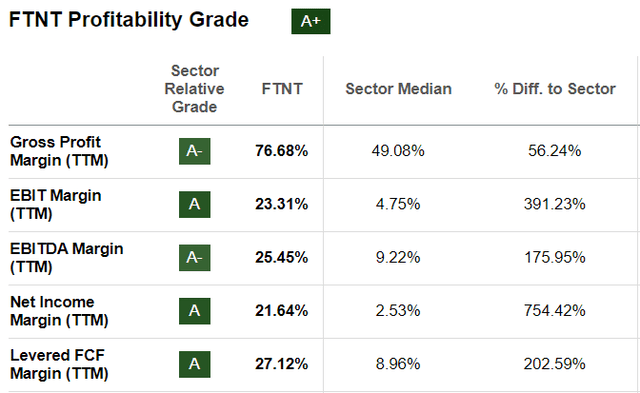

For this goal, the corporate can depend on excessive revenue margins (desk under), which might considerably cut back the affect of product reductions.

seekalpha.com

More importantly, the corporate has technological differentiators that may assist it navigate the market within the occasion of a value conflict.

To this finish, the corporate is the one networking firm to develop its personal ASICs (or application-specific built-in circuits) or custom-made chips for safety merchandise, in accordance with the CEO. The benefit right here is that this enables us to combine extra performance into the identical working system, particularly FortiOS. In different phrases, by utilizing ASICs, Fortinet can decrease its costs to the identical extent as corporations with out ASIC expertise.

However, Fortinet’s expertise differentiators is not going to assist it counter Palo Alto’s product energy because the chief within the SASE market, which is anticipated to develop at a CAGR of 25% from 2023 to 2028. Fortinet additionally reoriented its product strains to align with new financial realities. But watch on the sidelines and watch the way it responds to new threats, as market dynamics can change unexpectedly as analysts decrease their income estimates or the emergence of freemium enterprise fashions. implies that it’s fascinating. Finally, the corporate’s excessive valuation means that there seems to be a number of expectation already constructed into the inventory, and that it may very well be topic to excessive volatility if there may be unfavorable information. This is the explanation for my maintain place.