(Kitco News) – A brand new dot plot for US rates of interest and the upcoming FOMC assembly with Iranian parliamentary elections make March a pivotal month for the yellow metallic, in response to the most recent gold market commentary from the World Gold Council (WGC). It might be the moon.

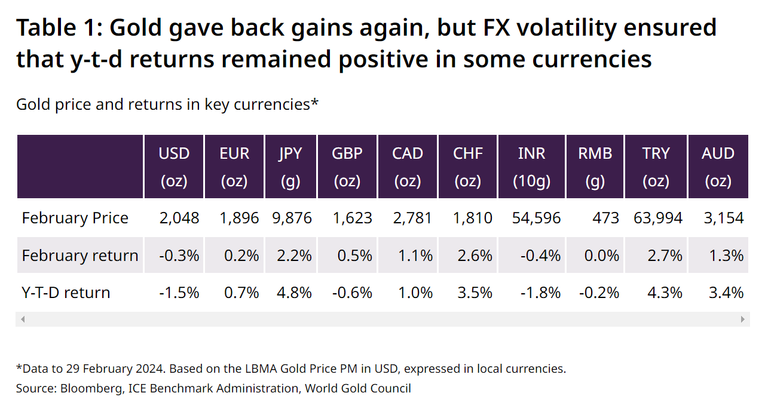

“Gold costs fell to $2,048 per ounce by the tip of February, down 0.3% month-on-month,” they famous. “Nonetheless, on account of forex volatility, year-to-date returns for the 4 main currencies have remained optimistic.”

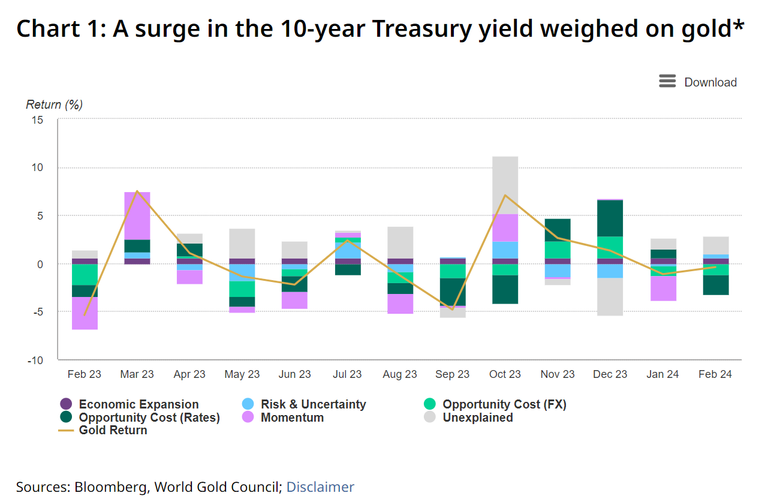

“According to our Gold Return Attribution Model (GRAM), the sharp rise within the US 10-year Treasury yield (+34bps) seems to be the primary driver of the gold worth decline. “This is no surprise contemplating the shock that has occurred over the previous two months,” they mentioned.

Analysts famous that continued outperformance of the so-called Magnificent Seven shares and “aggressive risk-on positioning” pushed by the NVIDIA-led AI frenzy additionally dampened curiosity in gold final month. “However, gold costs have rebounded because the finish of February once they exceeded US$2,100 per ounce.”

Looking forward to the rest of this month, WGC analysts have warned of two key occasions that might be pivotal for gold costs, one within the Middle East and one within the United States.

“Iran’s parliamentary elections mustn’t themselves create a ripple, however the nation’s shoppers are the key patrons of gold, and their elections might pave the best way for important political separation,” they mentioned. is writing.

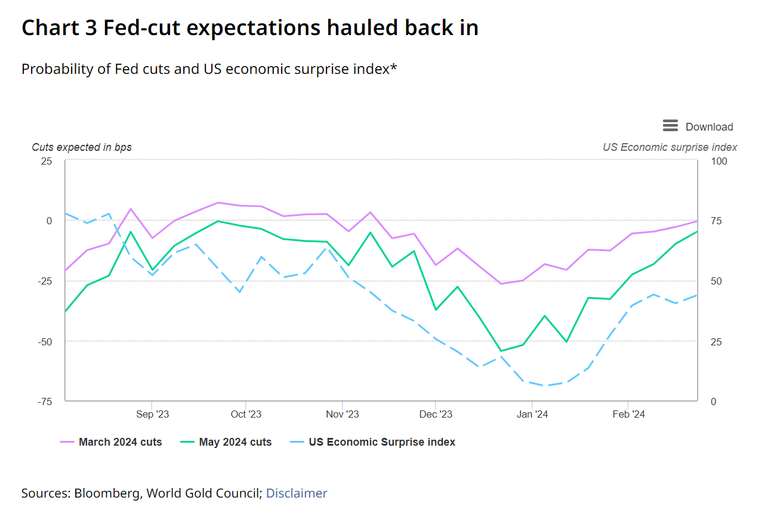

Another main occasion is the upcoming FOMC assembly in March. The WGC believes that is significantly necessary because it “will present traders with the primary set of outcomes following a robust set of information”, even when the market isn’t anticipating the transfer in rates of interest. There is. “This is the primary dot plot since December’s dovish tilt,” they mentioned. “Markets are pricing in charge cuts, however the arguments for it are simply as fierce because the arguments towards it. Uncertainty pervades financial coverage.”

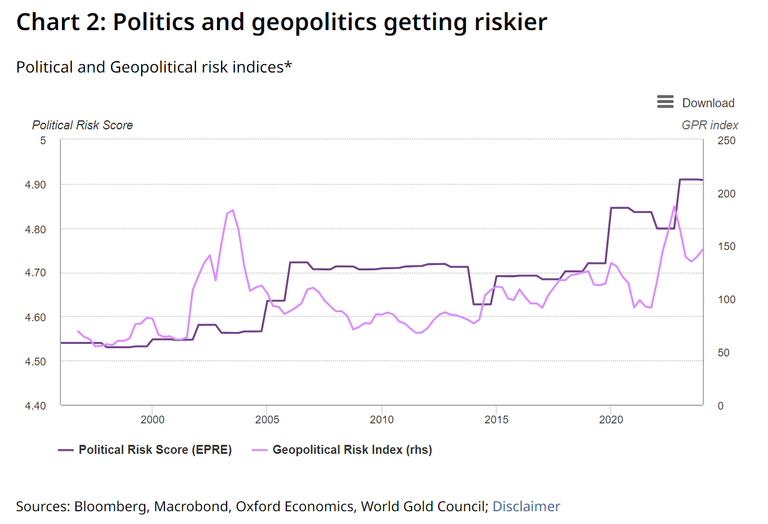

Looking additional forward, the Board famous that “2024 is fraught with dangers for political occasions,” as quite a few necessary elections might reshape the political map. “Some of those elections have cross-border implications, and there may be growing overlap between politics and geopolitics, which is necessary to traders,” they write.

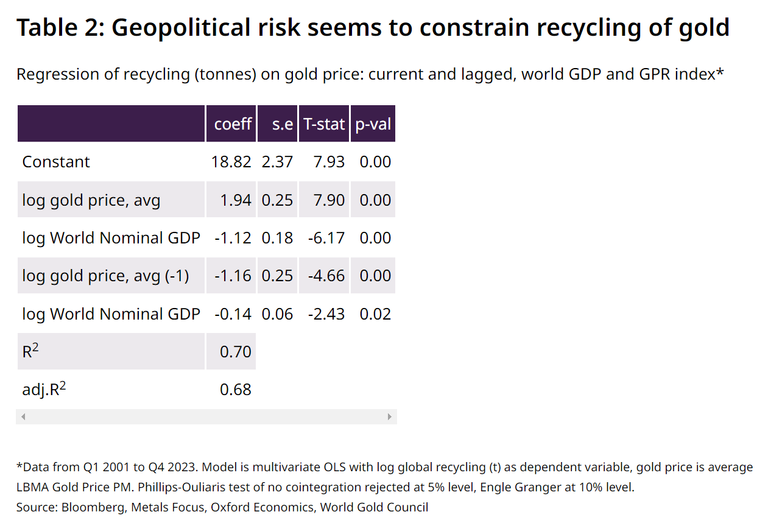

“As famous beforehand, geopolitical dangers seem to have a major impression on gold costs,” the analysts mentioned. “But this isn’t simply through funding channels. Anecdotally, gold holders in 2023, significantly within the Middle East and Europe, had been reluctant to half with their gold within the face of rising costs and financial hardship. Adding the Geopolitical Risk Index (GPR) to the worldwide recycling equation suggests important constraints on provide from this sector.”

The WGC estimates that recycling volumes will fall by 30 tonnes in 2023, reaching as much as 70 tonnes. “Geopolitical dangers subsequently look like broadly important, and we must be watching the election intently within the coming months to find out what meaning for cash,” Ana mentioned. The listing is written.

They identified that along with Iranian elections, Ukrainian elections had been additionally scheduled to be held this month, however that Ukraine known as off its elections.

“Parliamentary votes on Iran’s two legislative our bodies are unlikely to result in a lot change in a rustic the place voter antipathy is excessive,” they mentioned. “But one in all these our bodies might develop into extraordinarily necessary inside and outdoors Iran. The Assembly of Experts has one necessary job: to elect a brand new supreme chief. At his ripe age, Khamenei’s departure might be close to.”

WGC believes the Iranian elections might be necessary for gold traders for a wide range of causes.

First, they mentioned, “Iran is the sixth largest purchaser of bijou, bullion, and cash.” Second, “Khamenei’s presence is a recognized amount, and his successor might carry additional uncertainty to a area already mired in quagmire.”

And lastly, “Iran is reportedly reluctant to get immediately concerned in present points within the Middle East, however the actions of proxy militias improve the chance of Iranian involvement.” It identified. “As OPEC+’s third-largest oil producer, the corporate faces potential marginal dangers to international oil costs and the ensuing inflation and geopolitical implications.”

Geopolitical variables apart, the Fed stays the largest driver of gold costs within the March minutes, and the WGC believes current occasions throughout the pond make this assembly extra fascinating. There is.

“On Tuesday, February 20, Bank of England (BoE) Governor Andrew Bailey mentioned that inflation doesn’t want to achieve goal for the BoE to chop rates of interest,” they write. “It’s a daring assertion from one of many main central banks and it is pigeon bait. It’s true that the UK has simply skilled a statistical recession, and the ache is being felt extra viscerally within the family sector than within the US, however Investors have given up almost all bets on rate of interest cuts since January, which might encourage rate of interest doves.”

“Whether the Fed will take heed to different central banks and the market is a distinct story, though each are unlikely,” the analysts mentioned.

“Adding to the confusion, nonetheless, is the Fed’s potential unpredictability,” they famous. “Despite the discharge of strong inflation and financial information, December’s dovish flip proved that the Fed’s second-guessing generally is a gamble.”

They mentioned the up to date dotplot could be significantly fascinating given the discrepancies from the December assembly. “Will the Fed again away from its dovish course in December? Will the extensive dispersion inside the dots slender? Will the market present extra restraint than it did after the December assembly?”

Board analysts mentioned they proceed to imagine that charge cuts can be carried out by the tip of the yr and that recession dangers will stay contained. “However, even when coverage charges fall, long-term maturity yields aren’t destined to observe swimsuit,” they mentioned. “Does that bode badly for gold? Not essentially. The two main patrons in 2023, central banks and rising market retail traders, don’t have a very robust curiosity in long-maturity U.S. yields.”More , a failure to decrease yields on account of a decline within the Fed’s repurchase facility (RRP) might sign continued long-term premiums quite than rosy development expectations. This stays a priority all through 2023. At occasions, this was mirrored in traders’ reluctance to soak up U.S. Treasuries given basic fiscal and debt traits.

The WGC mentioned that whereas the Iranian elections and FOMC assembly aren’t anticipated to sign imminent change, “the relative calm in volatility indicators (MOVE for bonds and VIX for equities) means that surprises might be anticipated available in the market.” “This suggests the potential of triggering a robust motion sooner or later,” he concluded.

They additional observe that the sudden rally that noticed gold hit a number of all-time highs in early March was on account of “just lately reported robust demand from China, a quietly bullish sell-side gold forecast, and weak US ISM statistics.” “This means that the market is itching for a set off, supported by March 1st. ”

Disclaimer: The views expressed on this article are these of the creator and will not replicate the views of Kitco Metals Inc. The creator has made each effort to make sure the accuracy of the knowledge supplied. However, neither Kitco Metals Inc. nor the creator can assure such accuracy. This article is strictly for informational functions solely. It isn’t a solicitation for the change of merchandise, securities or different monetary devices. Kitco Metals Inc. and the creator of this text don’t settle for legal responsibility for losses and/or damages arising from using this publication.