It seems like Camping World Holdings (NYSE:CWH) goes ex-dividend inside the subsequent three days. Typically, the ex-dividend date is one enterprise day earlier than the report date, which is the date on which the corporate determines which shareholders are eligible to obtain dividends. When shopping for or promoting shares, the ex-dividend date is vital as a result of it takes at the very least two enterprise days for the commerce to settle. This signifies that buyers who bought Camping World Holdings shares after March thirteenth won’t obtain the dividend paid on March twenty ninth.

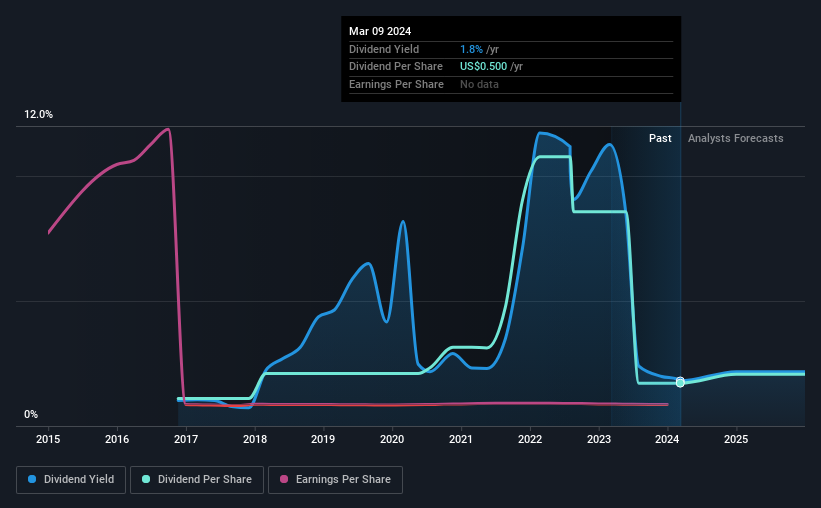

The firm’s subsequent dividend cost will likely be US$0.125 per share, following final yr’s whole of US$0.50 to shareholders. Based on the final yr of funds, Camping World Holdings inventory has a yield of about 1.8% on the present value of $27.76. If you purchase this enterprise for its dividend, you could perceive whether or not Camping His World Holdings’ dividend is dependable and sustainable. So we have to verify if the dividends are coated, and if earnings are rising.

Check out our newest evaluation for Camping World Holdings.

Dividends are sometimes paid out of firm earnings, so if an organization pays out greater than it earned, its dividend is normally at the next danger of being minimize. The unusually excessive payout ratio of 216% of income means that one thing totally different is occurring than the conventional distribution of income to shareholders. But money circulation is extra vital than revenue for assessing a dividend, so we have to see if the corporate generated sufficient money to pay its dividend. It distributed 38% of its free money circulation as dividends, which is a snug dividend degree for many corporations.

While Camping World Holdings’ dividend just isn’t coated by income, it is good to see that it is moderately priced, at the very least from a money perspective. If administration continues to pay out extra in dividends than the corporate experiences in income, we’d think about this a pink flag. Very few corporations can constantly pay out extra dividends than their income.

story continues

Click right here to see the corporate’s payout ratio and analyst estimates of its future dividends.

historic dividend

Are income and dividends rising?

Companies with promising development potential are normally those that pay essentially the most dividends, because it’s simpler to develop dividends when earnings per share are enhancing. Investors love dividends, so if earnings fall and the dividend is minimize, you’ll be able to count on the inventory to dump closely on the similar time. So we’re happy to see that Camping World Holdings’ earnings per share have grown by 20% per yr during the last 5 years.

Another vital option to measure an organization’s dividend prospects is by measuring its historic dividend development price. Based on the previous seven years of dividend funds, Camping World Holdings has grown its dividend by a median of 6.6% per yr. It’s encouraging to see the corporate elevating its dividend amid rising income, suggesting that the corporate has at the very least some curiosity in rewarding shareholders.

Summary

Should buyers purchase Camping World Holdings for its upcoming dividend? Why is Camping World Holdings buying and selling at a low money circulation payout ratio regardless of steadily rising earnings per share? It is questionable whether or not the corporate distributes a lot of its income as dividends. Overall, it is onerous to get enthusiastic about Camping World Holdings from a dividend perspective.

With that in thoughts, the important thing to thorough inventory analysis is to concentrate on the dangers at present going through a inventory. All corporations have dangers, and we have noticed 3 warning indicators for Camping World Holdings (of which 1 is a bit regarding!) it is best to learn about.

If you are out there for prime dividends, we advocate trying out our choose of the very best dividend shares.

Have suggestions on this text? Curious about its content material? Please contact us straight. Alternatively, e-mail our editorial workforce at Simplywallst.com.

This article by Simply Wall St is common in nature. We present commentary primarily based on historic knowledge and analyst forecasts utilizing solely unbiased methodologies, and articles are usually not supposed to be monetary recommendation. This just isn’t a advice to purchase or promote any inventory, and doesn’t keep in mind your aims or monetary state of affairs. We purpose to supply long-term, centered evaluation primarily based on elementary knowledge. Note that our evaluation might not issue within the newest bulletins or qualitative materials from price-sensitive corporations. Simply Wall St has no place in any shares talked about.