If you wish to spot potential multibaggers, there are sometimes underlying developments that may present clues. Ideally, your corporation will see two developments. First, a rise in return on capital employed (ROCE), and second, a rise within the quantity of capital employed. This reveals that it’s a compounding machine and the earnings may be constantly reinvested into the enterprise to generate larger income. With that in thoughts, once we checked out Armstrong World Industries (NYSE:AWI) and his ROCE development, we weren’t all that excited.

What is return on capital employed (ROCE)?

For those that aren’t certain what ROCE is, it measures the quantity of pre-tax revenue an organization can generate from the capital employed in its enterprise. This components for Armstrong World Industries is:

Return on Capital Employed = Earnings earlier than curiosity and tax (EBIT) ÷ (Total belongings – Current liabilities)

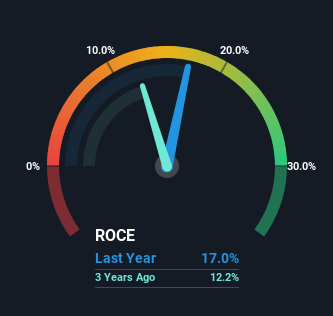

0.17 = USD 251 million ÷ (USD 1.7 billion – USD 195 million) (Based on trailing twelve months to December 2023).

Therefore, Armstrong World Industries has an ROCE of 17%. In absolute phrases, this can be a pretty regular return, considerably near the development business common of 16%.

Check out our newest evaluation for Armstrong World Industries.

rose

In the chart above, we measured Armstrong World Industries’ earlier ROCE in opposition to its earlier efficiency, however the future might be extra vital. To discover out what analysts are predicting for the longer term, take a look at our free analyst report for Armstrong World Industries.

What ROCE developments inform us

There is not a lot to report about Armstrong World Industries’s income and its stage of capital employed, as each metrics have been steady over the previous 5 years. This means that the corporate will not be reinvesting in itself, so it might be previous the expansion stage. With that in thoughts, we do not count on Armstrong World Industries to develop into a multibagger sooner or later until funding accelerates once more sooner or later.

story continues

Another factor to notice is that though ROCE has remained comparatively flat over the previous 5 years, present liabilities have declined to 12% of complete belongings, which is nice from a administration perspective. This permits corporations to remove a few of the dangers inherent in enterprise operations, as they’ve fewer excellent obligations to suppliers and short-term collectors than earlier than.

The conclusion is…

We can conclude that there are not any important adjustments to report concerning Armstrong World Industries’ return on capital employed and developments. The inventory value has risen 78% over the previous 5 years, so buyers ought to assume even higher issues are forward. After all, if the underlying developments maintain, we can’t be holding our breath to develop into multibaggers sooner or later.

Another factor to notice is that we have recognized 1 warning signal for Armstrong World Industries. You want to know this as a part of your funding course of.

Armstrong World Industries could not have the very best revenue margin in the mean time, however we have compiled an inventory of corporations which might be at present producing a return on fairness of 25% or larger. Check out our free record right here.

Have suggestions on this text? Curious about its content material? Please contact us immediately. Alternatively, e mail our editorial group at Simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary primarily based on historic information and analyst forecasts utilizing solely unbiased methodologies, and articles are usually not meant to be monetary recommendation. This will not be a advice to purchase or promote any inventory, and doesn’t take into consideration your goals or monetary state of affairs. We goal to supply long-term, targeted evaluation primarily based on elementary information. Note that our evaluation could not issue within the newest bulletins or qualitative materials from price-sensitive corporations. Simply Wall St has no place in any shares talked about.