Cybersecurity executives are embroiled in a confrontation. During a latest sequence of convention calls, and subsequent follow-ups on his Twitter/X, the CEOs of Palo Alto Networks (NASDAQ: PANW) and CrowdStrike Holdings (NASDAQ: CRWD) each talked about opponents, together with one another. attacked. CrowdStrike CEO George Kurtz even talked about Palo Alto by title in ready remarks. This is even supposing the 2 giants don’t immediately compete of their core companies of community safety (Palo Alto) and endpoint safety (CrowdStrike).

Meanwhile, small companies are reaching strong, worthwhile progress behind the scenes. One such cybersecurity supplier is his Qualys (NASDAQ:QLYS), which simply reported strong monetary outcomes once more. Despite the latest decline, the inventory value has doubled up to now 5 years. Here’s what buyers must find out about his Qualys in 2024 and past.

Attractive cybersecurity shares

Qualys gives a set of cloud-based software program instruments to assist organizations with safety compliance. Scans for safety vulnerabilities and suggests fixes for any weaknesses discovered. As IT infrastructures change into extra complicated with a mixture of conventional inner networks and public clouds, the variety of gadgets and apps that enormous enterprises want to trace and hold safe is quickly rising. The Qualys platform performs a essential position in your organization’s cybersecurity efforts.

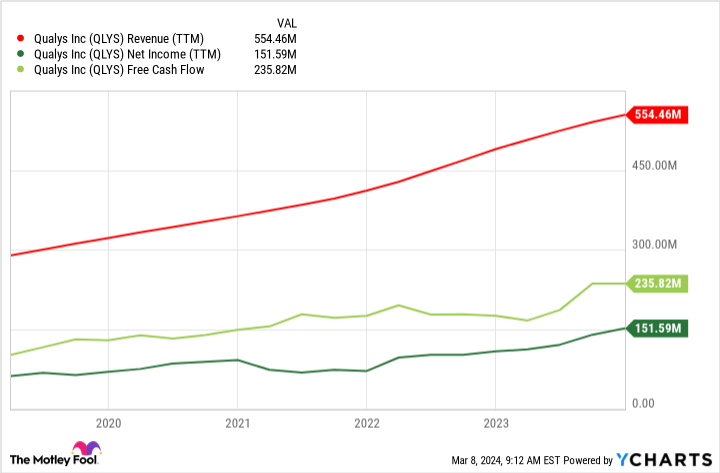

Qualys is not the fastest-growing cyber specialist within the business, however its common income progress since 2020 has been within the low to mid-10s. It’s a small firm with solely $555 million in income in 2023 (in comparison with the corporate’s billions in annual gross sales). (The largest pure cybersecurity initiative). And whereas many safety software program platform suppliers wrestle with profitability, Qualys truly presents buyers a beautiful proposition with strong GAAP web revenue and free money move (FCF) technology regardless of its measurement. offered to you. His FCF return final yr was a formidable 42.5%, making him one of many highest money mills amongst its peer group.

story continues

QLYS Revenue (TTM) Chart

Qualis is channeling nearly all of this FCF into share buybacks, returning $171 million and $317 million to shareholders in 2023 and 2022, respectively. The firm’s stability sheet is strong with $426 million in money and short-term investments, and no debt.

Qualys expects income to develop between 8% and 10% in 2024, primarily based on administration’s present outlook. Again, you will not discover a progress file right here, however when mixed with its profitability and wholesome stability sheet, there could possibly be loads to love about Qualys for the best investor.

Will competitors destroy Qualis?

As a extremely worthwhile firm, Qualys inventory is a uncommon worth play within the high-growth however often costly cybersecurity market. Qualys’ inventory at present trades at 42 instances its trailing 12-month earnings per share (EPS) and 27 instances his trailing-12-month FCF.

But a few of the maneuvering between Palo Alto and CrowdStrike might truly harm smaller firms like Qualis probably the most. The two cybersecurity giants are additionally increasing into ancillary areas. This consists of compliance and information safety posture administration (DSPM), the very area of interest Qualys, and different smaller friends like Tenable.

Both Palo Alto and CrowdStrike have acquired DSPM in latest months to develop their very own platforms and develop their safety software program market share (Palo Alto acquired Dig and Flow Security and bought CrowdStrike). (I simply introduced my participation).

This yr’s Qualys is certainly value watching. The firm remains to be placing up respectable numbers and clearly gives a priceless service that many organizations want proper now. However, resulting from elevated competitors, the inventory nonetheless seems to be just a little costly to me in the meanwhile, even in relative worth in comparison with its bigger friends. Still, I’m sufficient to keep watch over this small enterprise as 2024 progresses and the cybersecurity wars intensify.

Should you make investments $1,000 in Qualys now?

Before buying Qualys inventory, think about the next:

Motley Fool Stock Advisor’s group of analysts has recognized the ten finest shares for buyers to purchase proper now. Qualys was not amongst them. These 10 shares have the potential to generate spectacular returns over the subsequent few years.

Stock Advisor gives buyers with an easy-to-understand blueprint for fulfillment, together with steerage on portfolio building, common updates from analysts, and two new shares every month. Stock Advisor companies have greater than tripled S&P 500 returns since 2002*.

See 10 shares

*Stock Advisor returns as of March 8, 2024

Nicholas Rossolillo and his shoppers have positions at CrowdStrike and Palo Alto Networks. The Motley Fool has positions in and recommends CrowdStrike, Palo Alto Networks, and Qualys. The Motley Fool has a disclosure coverage.

1 Little-Knowed Cybersecurity Stocks Investors Should Watch in 2024 was initially printed by The Motley Fool