n.Bataev

Introduction and funding thesis

CrowdStrike (NASDAQ:CRWD) has been a dominant participant within the IT safety area for years, and seems to have solidified that place just lately. The firm’s one-stop-shop Falcon platform resonates with prospects and is mixed with new product strains to kind a novel gross sales proposition.

Last time, I coated the corporate following its fiscal Q3 24 earnings launch in December (CrowdStrike: Rule of 65 and its continuation). In doing so, he famous that an essential basic shift had taken place. The firm was in a position to develop its Rule of 40 metric (ARR Growth + FCF Margin) for the primary time within the final two years because of a major enhance in free money circulation margin. I’ve maintained that that is just the start and that enhancements on this metric must proceed. I primarily based my assumptions on the idea that the corporate’s FCF margins might broaden additional and that top-line development might re-accelerate because of sturdy efficiency in rising merchandise and a rise within the variety of built-in transactions. I’ve created a paper.

Based on the newest 2024 This autumn earnings report and accompanying earnings name, these forces seem like stationary, ensuing within the 40 meter rule rising additional to 68.

Given this pattern and the surprisingly sturdy deal pipeline the corporate reported, I imagine the optimism instantly following earnings is warranted. I feel the next consolidation will present entry alternative on the present valuation stage.

Concerns about IT safety spending fatigue are misunderstood

CRWD competitor Palo Alto Networks (PANW) posted a surprisingly conservative monetary outlook in February, and IT safety shares started to fall in line. PANW executives talked about buyer spending fatigue, which was in stark distinction to the overall perception that IT safety spending will proceed to extend by means of 2024 because the risk panorama worsens. CrowdStrike’s fiscal 2024 fourth-quarter earnings launch dispelled any final doubts that PANW’s issues weren’t company-specific.

Net new ARR reached a file $282 million, representing 27% year-over-year development. This is his second consecutive quarter of internet new ARR development reaccelerating, that means CrowdStrike’s new enterprise is rising considerably.

This resulted in whole ARR of $3.435 billion for the fourth quarter of fiscal 2024, representing 34.2% year-over-year development. This is barely beneath his 34.9% within the earlier quarter, indicating that buyers might witness a reversal in gross sales development quickly.

After a number of quarters of gradual slowdown in gross sales development, particularly at this dimension and excessive nominal gross sales development charge, there’s potential for reacceleration and proof of great basic power. The primary causes I feel that is potential are:

Management didn’t count on the common year-end funds to be flushed on the finish of FY24, however it occurred anyway. Remaining efficiency obligations (RPO) soared to $4.6 billion, accounting for about 150% of FY24 whole income. According to CRWD’s 10-Okay submitting, 60% of those obligations are anticipated to be realized throughout the subsequent 12 months, with roughly $25 billion in income already secured in fiscal 12 months 2025 and ongoing There is loads of room for development. Looking on the RPO graph, we are able to see that CrowdStrike ended FY24 on a really sturdy notice, despite the fact that the numbers for the previous three quarters are solely supplied as rounded numbers.

This autumn RPO development may very well be roughly 24%, which is a major enhance over the prior 12 months. I imagine this helps administration’s view of platform integration, which has been reiterated in current earnings calls. President and CEO George Kurtz cited a number of examples of aggressive acquisitions, citing Microsoft (MSFT), Palo Alto Networks, and Splunk (SPLK) as main fairness suppliers. Meanwhile, the win charge has elevated all through the quarter, displaying that CrowdStrike can be efficiently competing with non-legacy gamers.

On the product facet, CrowdStrike’s new product line continues to excel. His three primary options on this phase are cloud safety, identification safety, and his LogScale next-generation SIEM answer for the corporate. These merchandise had ARR of over $850 million on the finish of FY24, rising over 100% year-over-year and accounting for about 25% of whole ARR. Looking on the market penetration of those merchandise primarily based on CRWD’s estimates, there’s loads of room for continued spectacular development.

While the general market penetration of those options is simply within the low single digits, their penetration amongst current prospects can be very low, particularly within the case of Identity Security and LogScale next-generation SIEM. His TAM for these rising merchandise accounted for about $33 billion in his CY24 and will double in CY28. Based on this, these merchandise needs to be a key driver of gross sales development within the coming years.

It is welcome information that CRWD introduced the acquisition of Flow Security, a startup based in 2021 that excels in knowledge loss prevention, together with the discharge of its fourth quarter outcomes. This may very well be an essential step in including his fourth sturdy pillar to the rising product line, and with CrowdStrike, his TAM for this product will likely be his 40 in 2024. billion, and he expects it to double by 2028.

In addition to rising merchandise, the corporate’s core safety merchandise (endpoint safety, safety and IT operations, and managed companies) additionally had sturdy quarters. This is evidenced by the file variety of transactions involving 8 or extra modules, which greater than doubled in comparison with the earlier 12 months. This highlights the story of CrowdStrike’s integration on the Falcon platform, which seems to be a common pattern in IT safety. Based on the tendencies described above, CRWD is clearly a significant beneficiary of this pattern.

Finally, two essential developments on the product facet are the overall availability of Falcon for IT and Charlotte AI. Falcon for IT represents CrowdStrike’s newest effort into IT infrastructure administration by leveraging current expertise. This is a crucial step for the corporate to diversify its income streams past cybersecurity. Customer pleasure about this product may be very excessive, primarily based on administration’s feedback on the fourth quarter earnings name, so that is one other essential knowledge level to look at into 2024.

About Charlotte AI admins shared that 80% of beta customers imagine the answer will considerably enhance the effectivity of the platform. Now on the whole availability, I imagine this could grow to be a major new income stream over the following few years.

Based on the above, I feel CrowdStrike has engaging fundamentals in place for the following few years, and a reacceleration of gross sales could already be on the horizon. I feel considerations about pricing stress are overblown, as CRWD competes on high quality, not low-cost bundles. This means CRWD is attempting to teach potential and current prospects that what finally issues shouldn’t be the value they pay for a cybersecurity contract, however the whole price of working it. A single frictionless, automated, top-quality cybersecurity platform requires considerably fewer IT workers to function, to not point out potential breaches that usually price massive enterprises hundreds of thousands of {dollars}. It prices cash. This is the place CrowdStrike excels.

A fast have a look at revenue margins exhibits that the corporate’s gross revenue margins continued to broaden from already spectacular ranges. Total gross revenue margin reached 78%, a rise of just about 3 share factors 12 months over 12 months because of secure pricing and improved knowledge heart price effectivity. This resulted in a file non-GAAP working margin of 25%. His FCF era additionally hit a file within the fourth quarter at $282 million, which equates to his FCF return when measured towards income of 33%. Given these spectacular numbers, administration has elevated its FCF margin goal for FY2025 by 1 share level to 31% to 33%. This is sort of near the corporate’s long-term goal mannequin of 34% to 38%.

Based on these tendencies, I imagine the corporate’s Rule of 40 index has room for additional growth and will cross the 70 mark once more inside a number of quarters. I imagine it will proceed to make CrowdStrike his SaaS firm with one of the best (if not one of the best) fundamentals, making the inventory a vital a part of any high-growth expertise portfolio.

Assessment and threat elements

Of course, the inventory should not be purchased in any respect prices, however after evaluating the corporate’s future price-to-sales a number of towards its present development prospects, buyers should not purchase the inventory now. I do not see any compelling purpose. The inventory is at the moment buying and selling at a ahead P/S ratio of 20, which can appear wealthy at first look. However, on condition that CRWD maintains its present gross sales development charge of about 35% for the following three years, this ratio will drop to about 8 inside his three years, assuming a relentless inventory worth and no dilution. . This is in fact solely theoretical. This suggests a premium valuation is warranted till development prospects look stable.

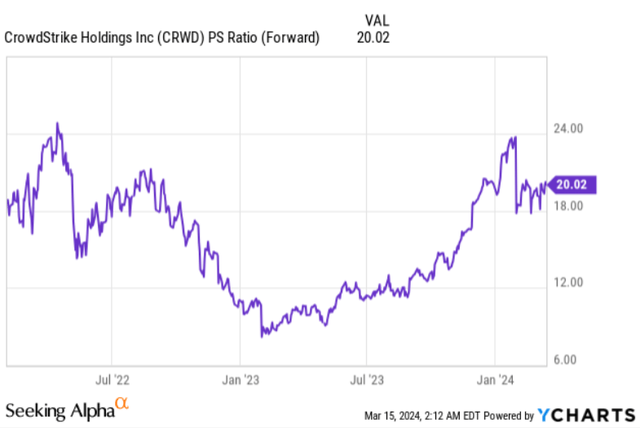

Over the previous two years, inventory valuations have fluctuated considerably.

Y chart

The future P/S ratio has damaged away from its peak of roughly 25 instances only one 12 months in the past, and reached its lowest level in two years at roughly 8 to 9 instances in early 2023. The inventory at the moment trades at round 20x, in comparison with a a number of of 24x initially of 2024, earlier than ahead gross sales estimates shifted to the following calendar 12 months. This is because of common threat sentiment, the outlook for long-term rates of interest, the overall enterprise cycle, and quite a lot of different elements that make the corporate’s inventory much less engaging regardless of the underlying outlook being comparatively secure. could also be evaluated over a really big selection. I imagine that the real looking risk of a comfortable touchdown coupled with modest rate of interest declines might help pretty constructive threat sentiment in 2024. Therefore, given CRWD’s sturdy fundamentals, its present ahead P/S ratio of 20 appears real looking. present atmosphere.

Below, we have now created three easy valuation eventualities primarily based on the idea that gross sales will develop at a CAGR of 35% over the following few years, mixed with 2% dilution per 12 months.

This signifies that if the inventory have been to finish 2024 on the 20x ahead P/S a number of it’s at the moment buying and selling at, the inventory ought to rise to $451.4 by the tip of the 12 months, which might imply ~37% upside potential. means. This is my fundamental state of affairs, the inventory worth might greater than double inside 3 years.

If rates of interest stay excessive for longer and valuation multiples for tech corporations are compressed to a point, a extra conservative P/S ratio of 15 would hold inventory costs fixed by means of 2024. However, even on this case, the inventory worth has room to rise considerably over a 12 months or extra. Expect a return of 80% over a three-year interval.

Finally, in a extra optimistic state of affairs the place valuation ranges rise additional and future P/S multiples attain 25x, the inventory might attain almost $1,000 in three years, triple its present stage. there’s. We imagine this state of affairs would require continued risk-on sentiment with decrease rates of interest, a secure macroeconomic and geopolitical atmosphere, and naturally continued sturdy execution by CrowdStrike. I do not suppose this state of affairs is unimaginable, however it assumes excellent situations.

It is essential to notice that these are only a few theoretical eventualities, and plenty of extra could happen in observe. This could rely on a number of essential threat elements confronted by CRWD. Competition within the cybersecurity area seems to be intensifying and is beginning to present itself in elevated pricing stress, as witnessed by Palo Alto Networks and Microsoft. CrowdStrike appears to have shrugged off these pressures up to now, however it’s essential to maintain an in depth eye on this subject.

Cybersecurity threats are additionally an essential threat issue on this area, and one or two main incidents can have a major influence on an organization’s inventory worth (see, for instance, Okta (OKTA)). CrowdStrike’s best-in-class Falcon platform has repeatedly outperformed IT safety checks, however this stays a major threat issue when investing on this area.

conclusion

CrowdStrike’s This autumn FY24 earnings defeated considerations of a possible slowdown in cybersecurity spending and confirmed the corporate ended FY24 on a really sturdy notice. Rapid development, rising product growth, and a big backlog of orders mix to place us strongly for FY25. This is confirmed by administration’s preliminary income development steering of ~30% 12 months over 12 months. This, mixed with gradual enchancment in revenue margins over the following few years, will seemingly proceed to drive the share worth larger.