Zscaler (NASDAQ: ZS) has emerged as one of many high cybersecurity firms. Although it’s a chief in zero belief safety (therefore its title), it gives cybersecurity on many fronts.

However, the corporate competes with firms like CrowdStrike, Palo Alto Networks, and Fortinet, so traders could also be hesitant to purchase this inventory, which has a ahead P/E of practically 70. Given that state of affairs, have traders waited too lengthy to purchase this cybersecurity inventory? Let’s take a better look.

Current standing of Zscaler

As talked about earlier, Zscaler has grow to be one of many high cybersecurity firms as a result of its position as an innovator in zero belief safety.

This is vital as a result of the appearance of the cloud and wi-fi cell gadgets has fully turned cybersecurity on its head. This transition has made the standard firewall method to safety out of date in some ways and requires a special technique.

Zero Trust safety treats each consumer as a possible menace. Determine entry utilizing traits resembling rank, location, and machine of people inside your group. Additionally, we permit a restricted diploma of entry to scale back the injury within the occasion of a safety breach.

Additionally, clients more and more want buying most or all of their safety merchandise from one firm. To this finish, Zscaler gives merchandise resembling Endpoint Security and Cloud Firewall that it could actually upsell to clients past Zero Trust merchandise.

Furthermore, Fortune Business Insights predicts that the worldwide cybersecurity market will develop at a mean annual charge of 14% by 2030. With such development, a rising tide is more likely to carry all ships in that business.

Zscaler’s monetary challenges

Zscaler inventory’s issues are mirrored in its monetary and different metrics. In the primary two quarters of fiscal 2024 (ending January thirty first), Zscaler generated simply over $1 billion in income, a rise of 38% in comparison with the identical interval in fiscal 2023, placing it in a robust place. Masu.

Additionally, internet income retention for the fiscal second quarter was 117%. Although down from the earlier quarter, this nonetheless means the typical long-term buyer spent 17% extra on his Zscaler merchandise than final yr, indicating strong income development. Masu.

story continues

The downside lies in profitability. Unlike most of its friends, Zscaler has by no means turned a revenue. Losses for the primary half of fiscal 2024 have been roughly $62 million, down from losses of $126 million for a similar interval in fiscal 2023.

This loss will likely be a combined blessing for traders. Achieving profitability stays a troublesome aim as stock-based compensation bills hit his $270 million mark. Nevertheless, stock-based compensation is a non-cash expense. This enabled Zscaler to generate constructive free money move of $326 million within the first half of fiscal 2024, limiting the unfavorable influence of losses.

This issue could clarify why traders have largely neglected internet losses. Despite falling practically 30%, the inventory has risen greater than 60% up to now yr.

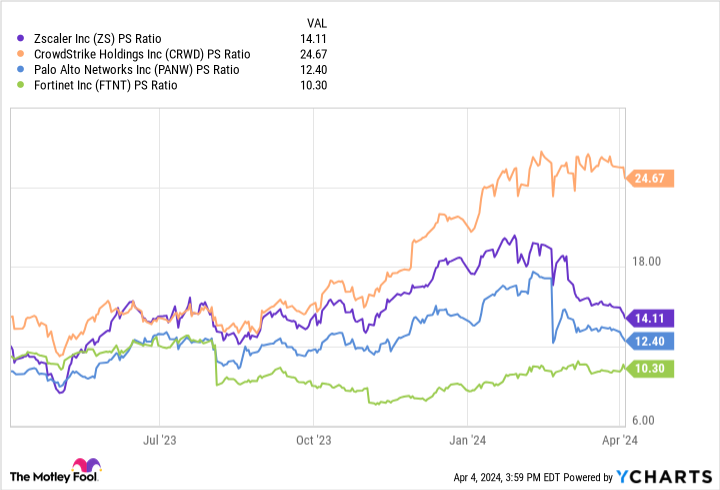

Additionally, whereas the valuation appears costly, it isn’t outlandish. With a P/S ratio of about 14, it’s dearer than Fortinet and Palo Alto, however offered at a larger low cost than CrowdStrike. Nevertheless, Zscaler is the one one in every of these 4 firms with a low P/E ratio, so many traders could really feel extra snug shopping for one in every of its rivals.

ZS PS ratio chart

Is it too late to purchase Zscaler inventory?

Given Zscaler’s present state of affairs, it might not be too late to purchase, however the larger query is whether or not the corporate is a purchase in comparison with its friends. Indeed, cybersecurity ought to proceed to be a quickly rising area for a while to come back, and the corporate’s management in zero belief safety means the corporate’s income and inventory value will probably enhance over time. .

Even extra unsure is whether or not Zscaler can outperform its friends. Since it has a better gross sales a number of than most shares apart from CrowdStrike, traders could ignore it in favor of lower-cost shares that earn earnings. This state of affairs makes Zscaler a considerably dangerous selection, though it ought to present advantages for traders.

Should you make investments $1,000 in Zscaler proper now?

Before shopping for Zscaler inventory, contemplate the next:

Motley Fool Stock Advisor’s staff of analysts has recognized the ten greatest shares for traders to purchase proper now. Zscaler was not amongst them. These 10 shares have the potential to generate spectacular returns over the subsequent few years.

Consider when Nvidia created this listing on April 15, 2005… If you invested $1,000 on the time of advice, you’ll have earned $539,230. *

Stock Advisor gives traders with an easy-to-understand blueprint for achievement, together with steering on portfolio building, common updates from analysts, and two new shares every month. Stock Advisor providers have elevated S&P 500 returns greater than 4x since 2002*.

See 10 shares »

*Stock Advisor will return as of April 4, 2024

Will Healy has positions at CrowdStrike and Zscaler. The Motley Fool has positions in and recommends CrowdStrike, Fortinet, Palo Alto Networks, and Zscaler. The Motley Fool has a disclosure coverage.

Is it too late to purchase Zscaler inventory? Originally revealed by The Motley Fool