Cybersecurity is a big trade, and its significance has by no means been better. Hackers are adept at breaking into programs and wreaking havoc on companies. Precautions should be taken to guard inner and buyer information.

This requires implementing one (or extra) cybersecurity options, leading to big demand for his or her merchandise, so traders ought to think about including cybersecurity shares to their portfolios. there may be.

Two of the preferred are Palo Alto Networks (NASDAQ: PANW) and CrowdStrike (NASDAQ: CRWD). But which one is healthier to purchase? Let’s test it out.

Palo Alto and CrowdStrike are fierce opponents

First, we are going to clarify every firm’s principal enterprise within the cybersecurity area.

Palo Alto divides its enterprise into three segments: community safety, cloud safety, and safety operations. The firm’s community safety enterprise contains firewalls and 0 belief platforms that stop outsiders from accessing networks. The firm’s cloud safety platform protects cloud workloads, and its safety operations platform contains merchandise equivalent to endpoint safety (an endpoint is a community entry system equivalent to a laptop computer) and risk detection response.

CrowdStrike has an analogous product line, however its authentic enterprise wasn’t firewalls like Palo Alto’s. It began with a cloud-first safety strategy that began with endpoint safety and has since expanded to different areas equivalent to id safety, cloud safety, risk intelligence, and endpoint detection response. Therefore, Palo Alto and CrowdStrike are direct opponents for a lot of of their companies.

But whenever you take a better have a look at their financials, leaders start to emerge.

CrowdStrike’s progress is predicted to stay robust this yr as effectively.

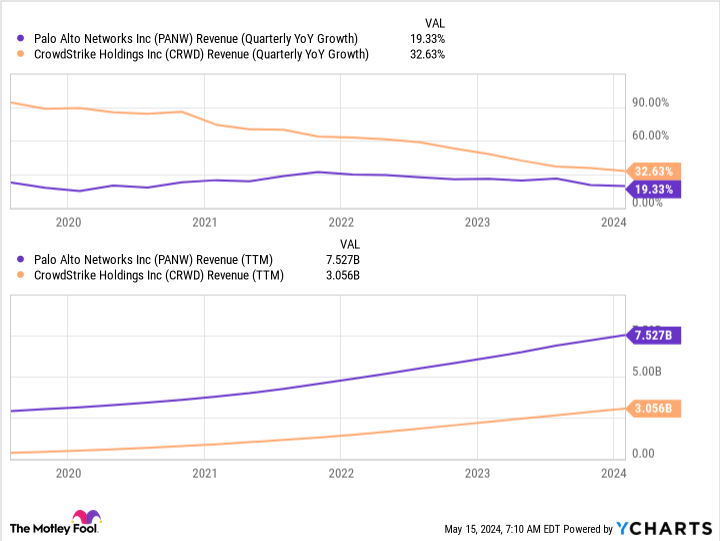

Looking at income progress alone, CrowdStrike seems to have a bonus. However, this can be a aspect impact of being a small enterprise. This is obvious in CrowdStrike’s progress trajectory, with year-over-year income progress slowing as the corporate scales up.

PANW Revenue (Quarterly YoY Growth Rate) Graph

CrowdStrike is rising quicker than Palo Alto, however the roles could possibly be reversed if Palo Alto reaches CrowdStrike’s measurement. But the longer term would not look so shiny for Palo Alto.

Palo Alto’s gross sales progress for the quarter ending April 30 is predicted to be solely 3%. (An earnings report is scheduled for Monday.) This is a giant crimson flag, particularly when in comparison with CrowdStrike and different cybersecurity corporations.

For the quarter ending April 30, CrowdStrike expects income of roughly $904 million, representing 31% progress. (Earnings studies are scheduled for June 4.) That’s a big distinction, and a sign that Palo Alto is struggling.

story continues

Or is it?

Palo Alto’s administration mentioned in a February convention name with analysts that the steerage was “the results of a strategic shift in our want to speed up each platformization and integration and energize our AI management.” Ta. This change is smart as a result of synthetic intelligence (AI) can play a significant function in highly effective cybersecurity merchandise.

However, since its inception, CrowdStrike has used AI to mechanically detect and reply to threats with out human intervention. This provides CrowdStrike an edge over Palo Alto Networks within the endpoint safety sport.

Which inventory?

For me, that is all I must declare CrowdStrike the winner. Palo Alto already has vital AI expertise, however Palo Alto is a latecomer.

CrowdStrike is by far the higher purchase right here, and I would not be shocked if CrowdStrike begins taking Palo Alto clients sooner or later.

Should you make investments $1,000 in Palo Alto Networks proper now?

Before shopping for Palo Alto Networks inventory, think about the next:

Motley Fool Stock Advisor’s group of analysts has recognized the ten finest shares for traders to purchase proper now. Palo Alto Networks was not amongst them. These 10 shares have the potential to generate spectacular returns over the subsequent few years.

Consider when Nvidia created this checklist on April 15, 2005… If you invested $1,000 on the time of advice, you’d have earned $566,624. *

Stock Advisor gives traders with an easy-to-understand blueprint for achievement, together with steerage on portfolio building, common updates from analysts, and two new shares every month. Stock Advisor companies have elevated S&P 500 returns greater than 4x since 2002*.

See 10 shares »

*Stock Advisor will return as of May 13, 2024

Keithen Drury has a place at CrowdStrike. The Motley Fool has a place in and recommends CrowdStrike and Palo Alto Networks. The Motley Fool has a disclosure coverage.

Improving Cybersecurity Stocks: Palo Alto Networks vs. CrowdStrike was initially printed by The Motley Fool