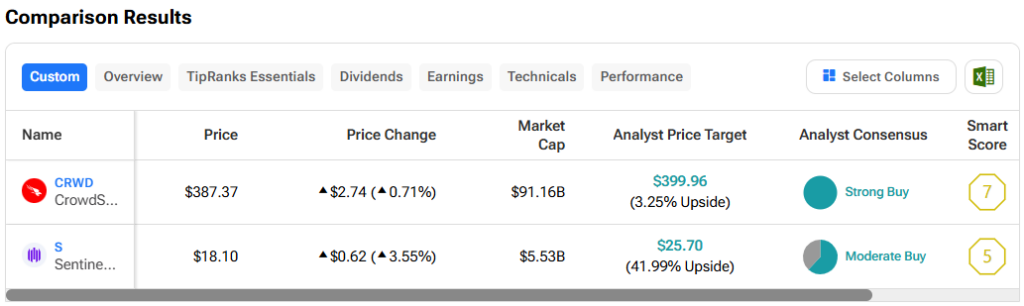

In this text, we’ve used TipRanks’ comparability device to guage two cybersecurity shares, CrowdStrike Holdings (NASDAQ:CRWD) and SentinalOne (NYSE:S), to see which one is healthier. Taking a better look, we have now a Neutral view on CrowdStrike and a Bearish view on SentinelOne.

CrowdStrike Holdings’ shares have soared 51% for the reason that starting of the yr and 154% over the previous yr, whereas SentinelOne’s shares have fallen 36% for the reason that starting of the yr however are nonetheless in constructive territory, having risen 11% over the previous yr.

With such a big distinction in year-to-date revenues between the 2 corporations, it isn’t shocking that there’s a distinction in valuation. Unfortunately, SentinelOne just isn’t worthwhile, so we are going to evaluate the price-to-sales ratios of the 2 corporations to check their valuations to one another and to the trade as a complete.

By comparability, the Application Software trade’s P/S is 8.8x, consistent with its three-year common, and its price-to-earnings (P/E) ratio is round 100x, increased than its three-year common of 155x.

CrowdStrike Holdings (NASDAQ:CRWD)

CrowdStrike seems to be buying and selling at a big premium to its trade friends, with a P/S of round 27.8 and a P/E of 721.9. While there may be nonetheless room for progress, the inventory is behaving like a bubble that’s about to burst, so a impartial view appears acceptable till a greater entry worth will be discovered.

CrowdStrike’s inventory worth has surged just lately following the corporate’s announcement that it’s going to be part of the S&P 500 (SPX) later this month, however a lot of it got here earlier than that. Once the inventory joins the index on June 24, we may even see additional positive factors because the remaining passive funds that observe the S&P purchase shares to replicate the index’s quarterly rebalancing.

With such a excessive valuation, it looks like it is solely a matter of time earlier than a correction happens. CrowdStrike officers have been reserving income because the inventory worth has risen, as evidenced by $63 million in data gross sales offers and quite a few automation gross sales offers prior to now three months.

Additionally, the corporate’s Relative Strength Index (RSI) is simply above 70, the purpose at which the inventory enters overbought territory.

Of course, there’s loads to love about CrowdStrike, and the explanation why turned clear in its latest earnings report: The firm beat income expectations and in addition beat earnings estimates by a large margin, reporting adjusted earnings of 93 cents per share on income of $921 million. The consensus estimate for the quarter was $904.6 million in income and 90 cents per share.

Therefore, I might be retaining a detailed eye on CrowdStrike to see the subsequent correction, as I imagine that is one inventory to purchase and maintain for the long run. Since its IPO in June 2019, the corporate’s shares have risen 545.8%, additional encouraging individuals to purchase shares as quickly because the providing begins. In the meantime, buyers who do not need to wait can purchase a number of shares, however could be clever to chorus from constructing massive positions on the present worth.

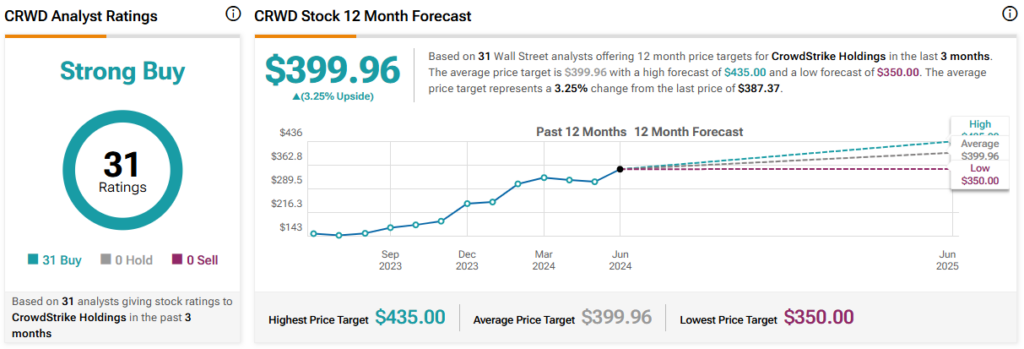

What is your worth goal for CRWD inventory?

CrowdStrike Holdings has a Strong Buy consensus score primarily based on 31 Buy, 0 Hold, and 0 Sell scores prior to now three months. The CrowdStrike inventory worth goal of $399.96 suggests an upside potential of three.3%.

SentinelOne (NYSE:S)

SentinelOne’s inventory is buying and selling at a P/S of 8.2, roughly consistent with the trade common. However, the corporate remains to be not worthwhile, and income progress slowed dramatically in the newest fiscal yr. Meanwhile, insiders have been promoting shares amid a steep decline within the inventory worth. Therefore, a bearish view appears acceptable, although the RSI is round 37, suggesting it might quickly enter oversold territory.

Like CrowdStrike, SentinelOne additionally posted spectacular income ends in its newest quarter: The firm posted an adjusted lack of 1 cent per share on income of $186.4 million, which beat the consensus estimate of a lack of 5 cents per share on income of $181.1 million.

SentinelOne remains to be unprofitable and solely a fraction of the scale of CrowdStrike, however the firm’s annual recurring income additionally grew 35% yr over yr to $762 million in the newest quarter. The firm reported its first quarterly constructive free money stream, which could possibly be the beginning of a quarterly turnaround.

Indeed, whereas SentinelOne’s complete income in the newest quarter elevated 40% yr over yr, its full-year income progress plummeted from 106% in fiscal 2023 to 47% in fiscal 2024 (ending in January). For fiscal 2025, SentinelOne lowered its income outlook to $808 million to $815 million, down from a spread of $812 million to $818 million final quarter.

SentinelOne subsequently stays largely a show-and-sell story, provided that administration hasn’t even talked about any progress towards enhancing profitability in its latest letter to buyers.

What is your goal worth for S shares?

SentinelOne has a Moderate Buy consensus score primarily based on 13 Buy, 8 Hold, and 0 Sell scores prior to now three months. SentinelOne’s common worth goal of $25.70 suggests an upside potential of 42%.

Conclusion: CRWD is Neutral, S is Bearish

CrowdStrike solely just lately turned worthwhile, but it surely needed to obtain at the very least 5 worthwhile quarters to be eligible to hitch the S&P 500. The firm is now worthwhile and is clearly on a trajectory for continued progress. However, CrowdStrike is pretty costly, so I’d be retaining a detailed eye on it as the subsequent correction could possibly be within the not-too-distant future.

Meanwhile, SentinelOne may ultimately grow to be the subsequent CrowdStrike, however that does not appear probably anytime quickly. The firm’s lack of profitability through the years is a giant concern, and I would want to see vital progress earlier than I could possibly be extra constructive on the inventory.

Disclosure