Click above to learn the PDF

Click above to learn the PDF

Cyber danger is inevitable. In as we speak’s enterprise setting, the aim is to not eradicate danger, however to handle it as effectively as attainable. The two primary approaches are to reply by implementing cyber controls and altering person habits, or to transition with cyber insurance coverage. These approaches are interrelated: robust controls cut back danger and ease entry to protection, whereas weak controls improve danger and make inexpensive insurance coverage more durable to acquire.

Today, we revealed a brand new report that explores this relationship intimately. Based on an authentic survey of 5,000 IT leaders, we discover cyber insurance coverage adoption amongst mid-market organizations, revealing what drives purchases, how protection investments influence insurance coverage uptake, and why the prices of cyber incidents aren’t all the time totally coated.

government abstract

In the face of inevitable cyber assaults, adopting a holistic strategy to cyber danger administration that leverages the interaction between cyber protection and cyber insurance coverage will help organizations decrease the full price of possession (TCO) of cyber danger administration and cut back the chance of a serious incident occurring.

The examine additionally discovered that investing in cyber protection not solely makes insurance coverage simpler to acquire and cheaper premiums, but additionally offers higher safety and reduces IT workload, additional highlighting the significance of contemplating cyber danger investments holistically and never as particular person parts.

One concern uncovered within the survey is that insurance coverage purchases might not align with enterprise wants. Cyber insurance coverage is an funding, so the insurance coverage must cowl the correct dangers. All stakeholders, particularly IT and cybersecurity groups, must be concerned within the insurance coverage choice to make sure it meets the group’s wants.

Cyber insurance coverage adoption is on the rise

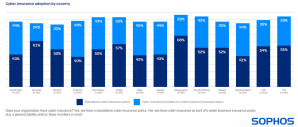

The survey discovered that cyber insurance coverage adoption is widespread amongst organizations with 100-5,000 workers, with 90% of organizations having some type of cyber insurance coverage. 50% have a stand-alone coverage, and 40% have cyber insurance coverage as a part of a broader enterprise insurance coverage coverage corresponding to normal legal responsibility. Adoption charges are excessive in all 14 nations surveyed, with Singapore reporting the best charges of insurance coverage protection.

General consciousness of the enterprise influence of cyber assaults is the most typical motive for insurance coverage buy.

Organizations have a variety of causes for taking out cyber insurance coverage, however practically half (48%) cite the perceived enterprise influence of a cyber assault as their main motivation. 45% say cyber insurance coverage is a part of a cyber danger mitigation technique, and 42% say it’s a necessity to work with clients or companions who require cyber insurance coverage.

Investing in cyber defenses to optimize your insurance coverage place is widespread follow, and the advantages are

Of organizations that bought cyber insurance coverage final yr, 97% have strengthened their defenses to optimize their insurance coverage place, with virtually two-thirds (63%) making main investments and 34% making smaller investments.

These safety investments are paying off, with the survey exhibiting that just about all companies which have invested in strengthening their cyber defenses have seen a constructive influence on their cyber insurance coverage place (99.6%, or 4,351 of 4,370 respondents).

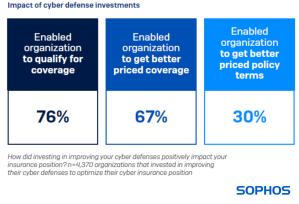

Cyber insurance coverage necessities are encouraging organizations to up their defenses (the “stick”), with 76% of respondents saying their investments helped them safe protection they may not have obtained in any other case. The “carrot” was that two-thirds (67%) had been capable of get lower-cost protection, and 30% acquired higher phrases by improved safety (e.g. greater protection limits).

What’s extra, organizations that invested in safety noticed advantages past insurance coverage: 99% reported a variety of advantages, together with higher safety, fewer alerts, and decreased IT workload.

Insurance firms virtually all the time pay claims in some type.

Organisations which have invested in cyber insurance coverage will likely be inspired to know that insurers virtually all the time pay out claims in some type, with just one respondent saying {that a} declare had been denied outright.

At the identical time, in 99% of claims, insurers didn’t cowl the complete price of the accident. Overall, insurers usually paid 63% of the full price of the accident, with essentially the most frequent fee price being between 71% and 80%.

Why aren’t all prices coated?

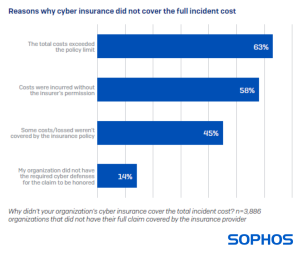

The survey additionally discovered that the price of recovering from a cyberattack is exceeding insurance coverage protection. The most typical motive (63%) for restoration prices not being paid in full was that the full price exceeded insurance coverage limits. According to Sophos’s State of Ransomware 2024 survey, the price of recovering after a ransomware incident has elevated by 50% prior to now yr, doubtlessly making a mismatch between insurance policies and prices.

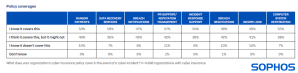

There is widespread uncertainty about what insurance coverage will cowl within the occasion of a cyber incident

Many cybersecurity/IT leaders are uncertain of what their firm’s insurance policies cowl within the occasion of an incident. Of those that have a coverage, 40% imagine it covers paying ransoms, and 41% imagine it covers lack of income however aren’t positive. These findings are regarding on a number of fronts.

Organizations danger not getting the compensation they want – 45% of respondents who weren’t totally coated for accident prices mentioned some prices/losses weren’t coated by insurance coverage – and organizations danger not getting the help they anticipate within the occasion of a declare.

The lack of transparency about insurance coverage protection is probably going due, at the least partially, to a disconnect between those that purchase insurance coverage and people on the entrance traces when a critical incident happens.

Read the complete report

For extra detailed data, together with how cyber insurance coverage protection impacts ransomware losses and plenty of different areas, obtain the complete report.

About the survey

The report relies on findings from an unbiased, vendor-neutral survey commissioned by Sophos of 5,000 IT and cybersecurity leaders throughout 14 nations within the Americas, EMEA and Asia-Pacific. All respondents represented organizations with between 100 and 5,000 workers. The survey was carried out by analysis specialist Vanson Bourne in January-February 2024, and members had been requested to base their responses on their expertise within the earlier yr.