50 Ruffer curve

At the Capitol on May thirteenth, company on the festive dinner celebrated an anniversary that isn’t on the official calendar, however must be.

On September 13, 1974, younger economist Arthur Laffer was making an attempt to clarify the factors in regards to the optimum tax fee, that’s, the speed that optimized each tax income and financial development. Translated his quick movement of phrases right into a single image, Laffer drew a convex form to the one one which was handy: restaurant napkins.

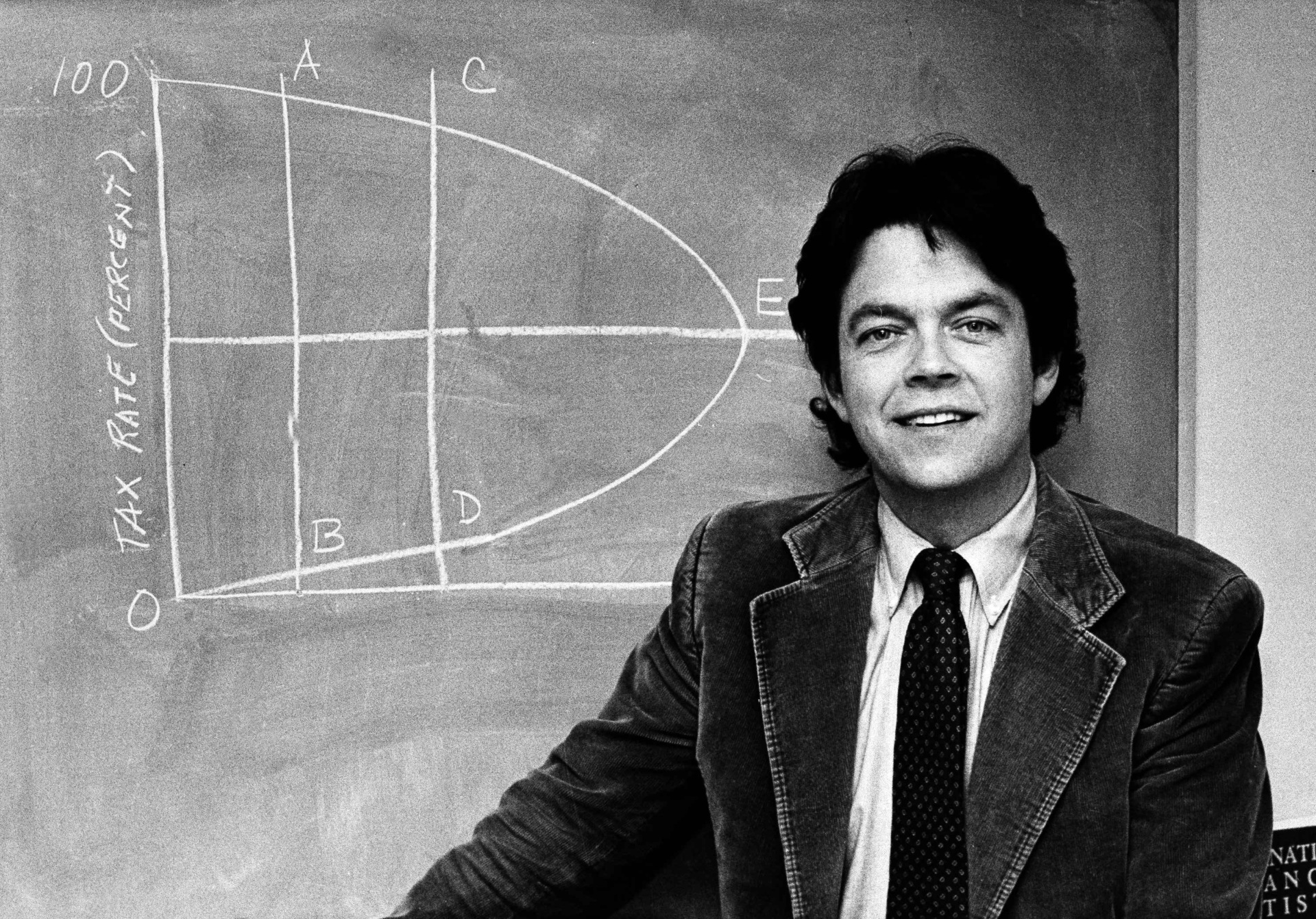

Economist Arthur Laffer stands in entrance of his well-known Ruffer Curve chalkboard drawings round 1981 (AP photograph)

Laffer argued that there are two tax charges and the federal government would earn zero income. It’s zero % and 100%. Of course, at a 100% tax fee, the return after tax is zero. So there is no such thing as a cause to do work or generate earnings. But someplace between zero and 100 is the perfect fee to generate income and development. Laffer claimed that the present fee (as much as 70% has since been too excessive for revenues, so in case you can lower the tax fee, you’ll truly enhance your income (and development).

Interestingly, Laffer himself by no means claimed credit score for this perception. In the 14th century, the Arab thinker Ibn Khaldun gave the identical level. Similarly, there have been later thinkers, similar to Adam Smith and John Stuart Mill. In truth, not too long ago in 1962, President John F. Kennedy declared, “The paradoxical fact is that tax charges are too excessive and too low, and the healthiest option to make earnings in the long run is to chop tax charges now.”

But nonetheless, Laffer’s contributions have been profound. He distilled all this knowledge right into a single, imply visualization. Indeed, with the assistance of others, together with the late Jude Waniski, who first blows the Laffer curve away, Laffer expanded this imaginative and prescient into a college of considering that focuses on productiveness and abundance.

Republicans and Democrats resisted supply-side economics

But like new concepts, the guardians of previous concepts have been questionable and hostile. Democrat Kennedy embraced the character of supply-side considering, however the financial system boomed after his tax cuts have been enacted in 1964, however most Democrats opposed it.

why? They could not settle for the concept made the wealthy appear to be descending simply. “Social justice,” they stated, was higher served by “immersing the wealthy.” Certainly to today, most Democrats are assured by such ideas.

As for Republicans, the concept they might lower taxes was to extend their earnings. They stated it was higher to take care of earnings and maintain the deficit very shut. The proven fact that Laffer and his allies have been saying they have been chopping tax charges was misplaced within the brains of those elephants in that tax revenues truly rise.

In truth, by the late Nineteen Sixties, each events had settled into an odd anti-growth consensus. Higher taxes and heavier laws. The outcomes have been predictable. Even as inflation spiked, financial development was forking out.

In the waning decade of the Nineteen Seventies, Luffer drew his well-known curves. Later, along with his distinctive enthusiasm, Luffer persuaded many Republicans and a few Democrats, who would persuade the financial system to flee the funk by tax cuts.

Reagan modified the paradigm

The greatest of those new allies was Ronald Reagan. As the fortieth president from 1981 to 1989, he lower tax charges throughout the board. The highest particular person fee fell 42 factors, whereas the corporate fee fell 12 factors. Of course, the financial system grew quickly: inflation and unemployment charges fell, however precise GDP elevated by a 3rd.

Economist Arthur Laffer (left) and former California governor Ronald Reagan loved anecdotes at a businessman assembly in June 1978 (Bettmann/Getty Images)

Over the subsequent half century, the charges have been lowered attributable to some changes up and down. Result: A protracted increase. The precise per capita GDP is 2.5 instances greater than in 1974.

Now, President Donald Trump is main a brand new spherical of growth-enhancing insurance policies, holding a tax line, pushing up deregulation and vitality management, and making grand enterprise transactions. And new capital and investments are dashing into the United States. Finally, it is a 12 trillion greenback rely. And Trump has taken full care of Laffer’s contributions. In 2019, he was awarded the Presidential Medal of Freedom.

President Donald Trump will likely be introducing President Arthur B. Laffer’s Medal of Freedom on June 19, 2019 in his oval workplace, “father of the supply-side financial system.” (Official White House photograph by Joyce N. Bogosian)

So sure, there was lots to have a good time on the Capitol. Laffer, now 84 years previous, is hosted by Steve Moore of Unleash Prosperity, a bunch devoted to development promotion insurance policies. House speaker Mike Johnson (R-LA) praised Luffer as a longtime ally, together with Kellyanne Conway, John Fund, Rep. Darrell Issa (R-CA), Sen. Rand Paul, Jimmy Kemp, Lisa Nelson, Richard Larne, Peter Lough, Avik Roy, Judy Shelton – Kerry Ann Fund of Nodd in Nord’s.

Still, within the comfortable toast there was a severe objective. Still filled with vitality and perception, Laffer himself laid out the teachings he discovered in at the least half a century and within the subsequent steps, beginning with the Trump Tax Bill earlier than Congress. One of the objectives is to cut back the company earnings tax fee to a decrease stage than its key opponents, significantly China.

Looking additional, there’s a wider and higher future to form. We should thank only a small portion of the Luffer curve of the 1974 Ereka second worthy of a everlasting memorial, and imagine that this can be a battle of concepts that we will win, with the general supply-side considering.

Oh, yet another factor: Art Laffer deserves a Nobel Prize. No one lives have achieved extra for financial development, alternatives, and human prosperity.

– Today’s Breitbart Business Digest was written by James P. Pinkerton.